- From there, you can change the PIN, and once you have done so, you need to enter the OTP to verify that you have changed your UPI PIN.

- Now, you can not stop all the scammers, but you sure can enable the settings that I will be sharing in this article.

- Yes, if you enable the notification alert on your bank apps, you will receive an alert every time a transaction occurs.

UPI is my go-to payment method, as it is for millions of others as well. Most of us now only carry minimal cash, as every vendor or shop now has UPI. In Digital India’s most successful campaign, we can say that UPI payments are safer than other payment methods, but are not immune to scams. People who scam us are also getting more innovative and creative in their methods. There are now apps that are perfect copies of the UPI apps we use, minus the actual money. These apps will generate an amount deduction animation, sound, and even an announcement on the shop owner’s soundbox.

Now, you can not stop all the scammers, but you sure can enable the settings that I will be sharing in this article. After you have enabled these settings, you will never fall prey to a UPI scam ever.

Best Ways To Prevent UPI Fraud

Scammers have been stepping up their game, and now they have functional apps that can mimic the original UPI payments apps. You get the transaction’s notification, sound, and even a reference ID. Even the UPI soundbox vendors used to announce the payments made by these fake apps. This is both impressive and scary at the same time. So, to avoid this, I have curated my own checklist and will share it with you. First, enable the email notification settings of your payment apps. Here is how you can do it,

1. Enabling the Payments Notification for UPI Apps

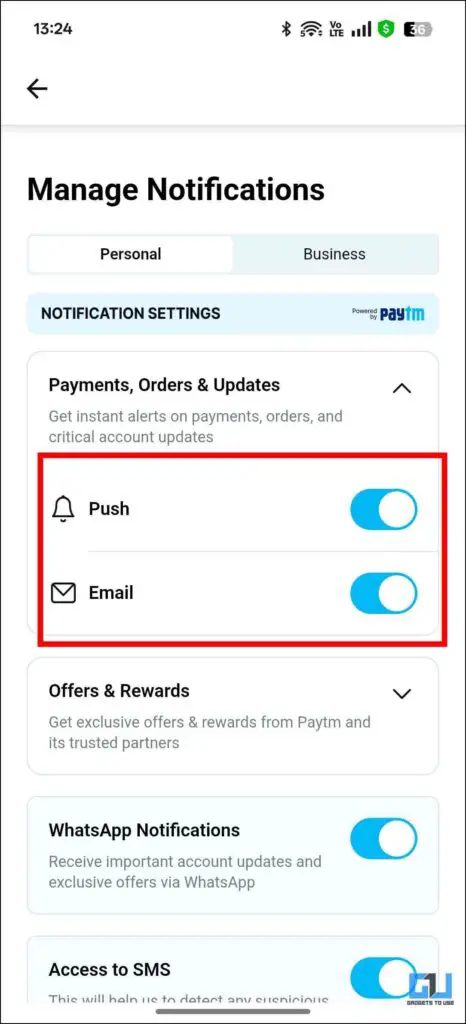

Once you have enabled this, you will receive an email notification for every transaction made using your UPI app. This is a great way to know if money is debited or credited from your account. If you are getting scammed, this can save you. The steps to enable it are mentioned below.

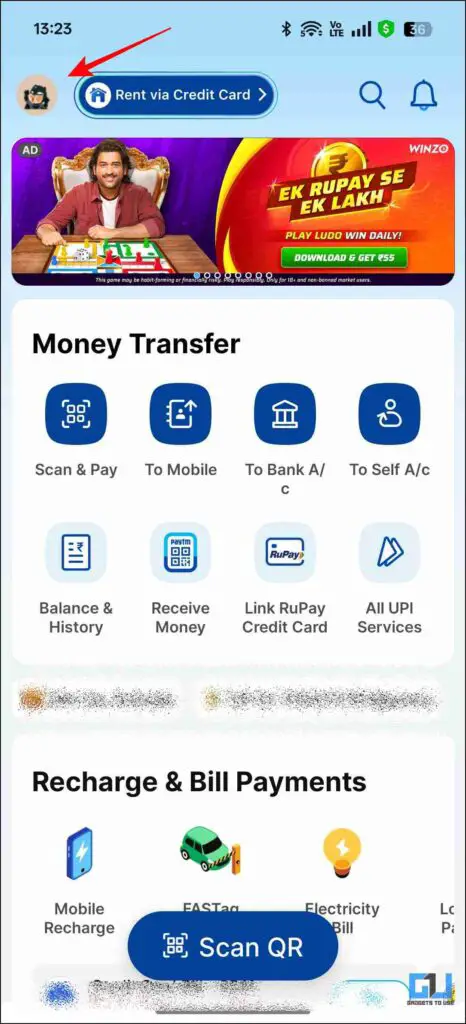

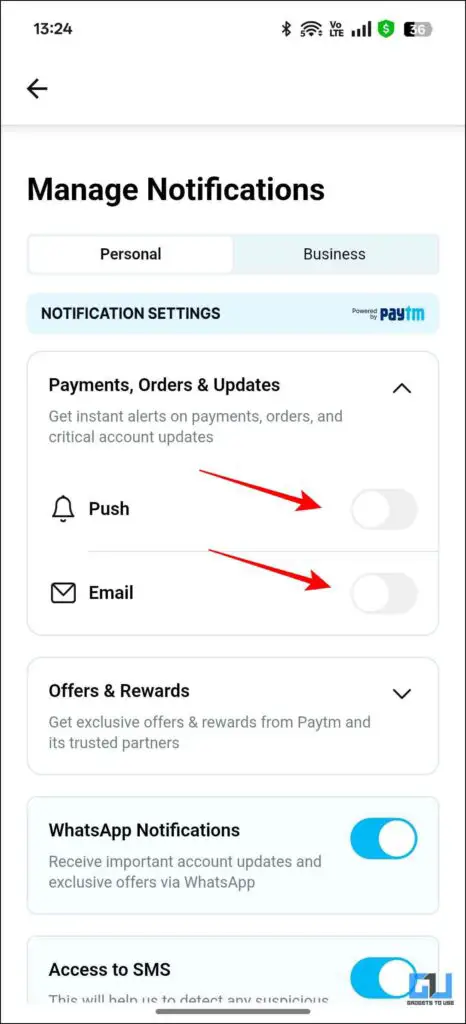

1. Open the UPI app you use.

2. I am using Paytm. Click on the top left of the profile icon.

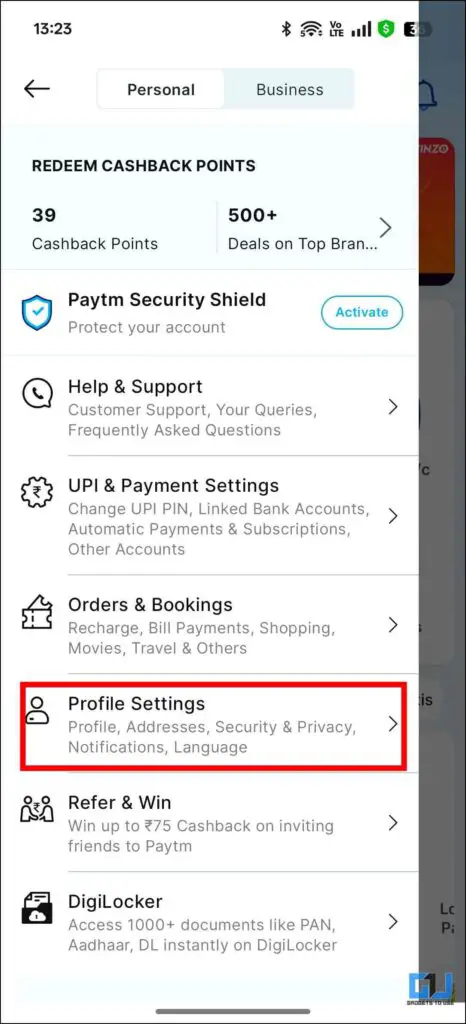

3. Scroll down to Profile Settings and open them.

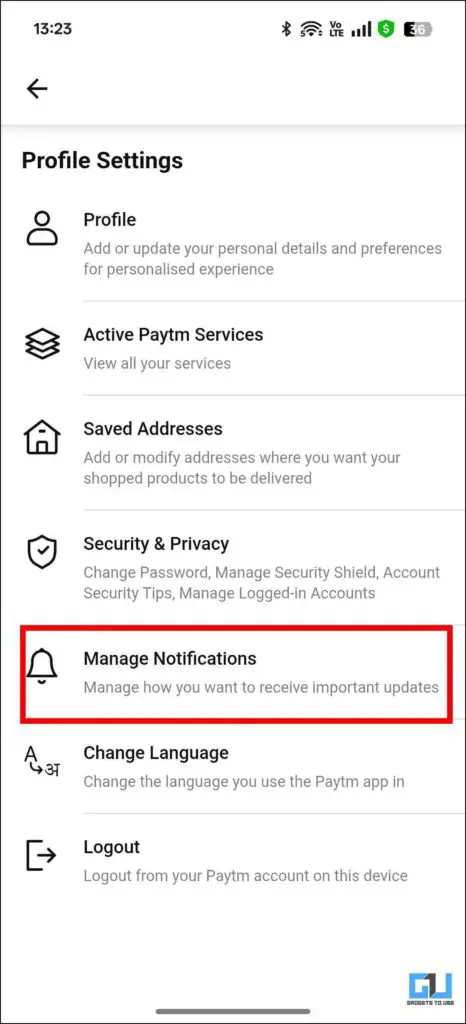

4. Then, from there, click on Manage Notifications.

5. Toggle on the Push and Email notifications for payments.

2. Keep Track of E-Passbook

The other most useful method is to keep track of your E-passbook. Simply keep the passbook open on your phone and refresh it once you have received the payment. I understand this can be tardy if you operate a busy show, but this is still safer than losing money. This is a foolproof method in which you can not be scammed. You can also do the same with the transaction history of any of the UPI applications you use.

3. Enable Email and SMS Notifications

The final setting you need to know is the notifications from the native bank apps you use. Yes, if you enable the notification alert on your bank apps, you will receive an alert every time a transaction occurs. This can be done directly from the application. Once you have enabled this, you will receive alerts via email or SMS on your registered mobile number.

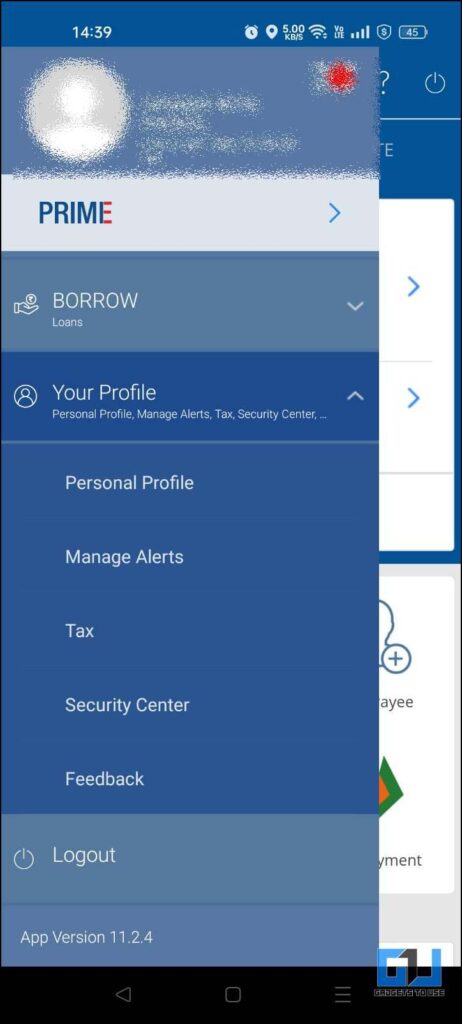

1. Open your preferred Bank app.

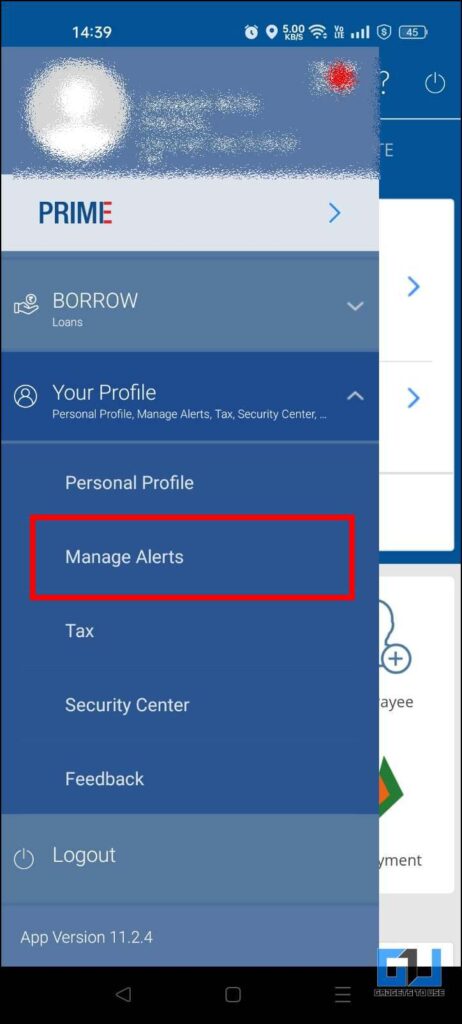

2. Search for ‘notification’ or ‘alerts’ settings. The option will vary by bank.

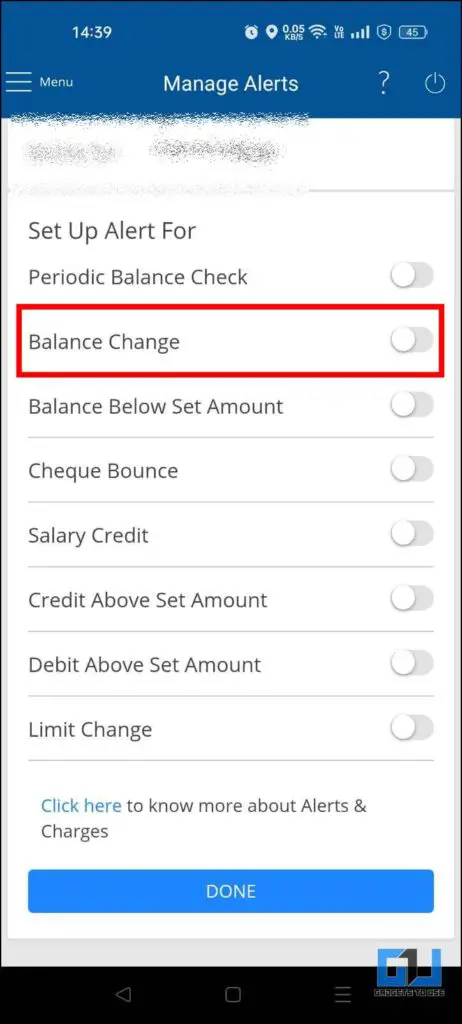

3. Our banking app has a Manage Alerts section.

4. Here we can set alerts for balance change, debit notifications, and many other type of transactions.

FAQs

Q. How can I change my UPI pin?

To change your UPI pin, open your UPI app and go to Bank Accounts > UPI Pin > Change UPI pin. From there, you can change the PIN, and once you have done so, you need to enter the OTP to verify that you have changed your UPI PIN.

Q. How can I enable UPI Lite in Paytm?

Head over to the Paytm application. Search UPI Lite and you will see the icon to enable UPI lite, click on it and fill in the required details.

Wrapping Up

This article is all about securing your UPI account so that you do not get scammed by fake apps on the market. These apps are harmful, and a lot of vendors lose money because of them. Enabling the settings discussed in this article can save you a lot of money and you will be able to keep a better track of your earnings as well.

You may also like to read:

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join the GadgetsToUse Telegram Group, or subscribe to the GadgetsToUse Youtube Channel for the latest review videos.

Was this article helpful?

YesNo