Stocks surged on Wednesday afternoon, ripping higher after President Trump said he would back down on tariffs for most of the world for the next 90 days, citing new talks with foreign nations.

The S&P 500 climbed over 7 percent in a matter of minutes after Mr. Trump posted the decision on Truth Social, sharply reversing days of losses.

It was a drastic turn for a market that has been racked by anxiety about the rollout of the new tariffs, which had taken effect before Mr. Trump announced the pause. The sharp reversal left the S&P 500 9.5 percent higher Wednesday, its best day since the recovery from the 2008 financial crisis.

Some analysts cautioned that while the tariff reprieve was welcome, more volatility could still be ahead. The 90-day pause did not eliminate the profound uncertainty that has weighed on the stock market for weeks as Mr. Trump has revealed his tariff plans, leaving companies often guessing how the ever-changing trade sanctions might affect their businesses.

On Wednesday, Trump administration officials boasted that many nations were now willing to negotiate trade deals with the United States, but the outcome of those talks could remain unclear for months, prolonging the uncertainty for companies, investors and consumers.

“The tariff clouds parted for the first time today, but it’s too soon to know how sunny the skies will be tomorrow — or 90 days from now,” said Daniel Skelly, head of the wealth management market research and strategy team at Morgan Stanley. “As welcome as the announcement was, investors can’t assume it’s the end of the tariff story, or that the market’s day-to-day volatility will disappear.”

Despite the pause on some country-specific tariffs, Karoline Leavitt, the White House press secretary, told reporters that a tariff of 10 percent would remain in place across America’s trading partners.

Another weight on stock markets going forward is the fact that the pause does not extend to China. Mr. Trump said he would instead raise tariffs on Chinese exports to 125 percent after Beijing announced a new round of retaliation duties. Beijing had earlier added its own 50 percent levy on American goods in response, bringing the total tariff on U.S. exports to China to 84 percent.

“Respite? Further economic suicide?” said Peter Boockvar, chief investment officer of Bleakley Financial Group. “It will all depend on where you source product from, of course, and unfortunately about $450 billion is still being imported from China.”

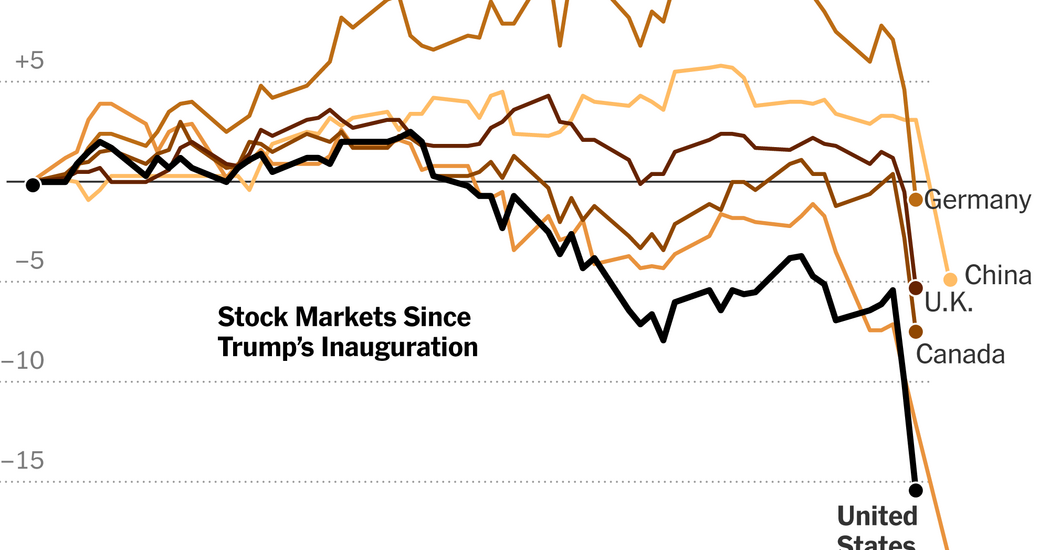

Even after the S&P 500’s sharp rise on Wednesday, the index remains 11.2 percent below its most recent high, in February. The tech-heavy Nasdaq Composite index rose 12.2 percent but is still roughly 15 percent below its December high. The Russell 2000 index of smaller companies more exposed to the outlook of the economy is roughly 22 percent below its November high.

It remains the S&P 500’s worst start to a presidential term since the dot-com bubble was bursting at the beginning of 2001.

Mr. Trump, who for weeks has shrugged off concerns about the market’s steep decline, posted a bullish signal on his social media platform, Truth Social, just hours before the pause on tariffs was announced. When stocks were still oscillating between small gains and losses, he posted, “BE COOL,” adding, “THIS IS A GREAT TIME TO BUY!!!”

The announcement of the pause caused stocks across industries to soar. Airlines and some tech companies were among the ones to soar over 20 percent.

Shares of automakers rose sharply even with 25 percent tariffs on imported cars in place. Ford Motor rose 9.3 percent and General Motors 7.7 percent.

A 19 percent rise for Nvidia added roughly $450 million to its market value. Tesla rose 22.4 percent, adding $160 million to its valuation.

Highlighting the erratic trading conditions, a raft of stocks listed on the Nasdaq hit market speed bumps and were halted after lurching higher, a common practice to prevent rapid changes in the price of a stock or stock index from getting out of control.

“Investors should brace for more market volatility in the coming weeks and months as Trump’s trade policy becomes more coherent,” said Michael Arone, a chief investment strategist at State Street Global Advisors. “The trade war may not be over, but at least for today investors have won the battle.”

Oil prices rose, as did the U.S. dollar. The yield on short-dated government debt also rose, a sign that investors were dialing back expectations for interest rate cuts to prop up the economy after the threat of tariffs had been reduced. Other measures of worry also eased.

Markets in Asia and Europe, which had closed for trading before Mr. Trump’s new tariff announcement, mostly slumped: Taiwan’s was the worst hit, sinking more than 5 percent, while benchmark indexes fell more than 3 percent in Japan.

The Stoxx Europe 600 fell 3.5 percent and the FTSE 100 in London about 3 percent.

Treasury Secretary Scott Bessent tried to spin the pause as part of Mr. Trump’s strategy and not a capitulation, saying the tariffs had worked to get some of China’s closest neighbors to seek deals with the United States. “Do not retaliate, and you will be rewarded,” he said.

This week, Japan emerged as the first major economy to secure priority tariff negotiations with the Trump administration. The news prompted a brief surge in Tokyo-listed stocks before they resumed their decline on Wednesday.

Some analysts warned that even as U.S. markets rose on Wednesday, the threats that the Trump administration’s aggressive tariffs posed to the economy had not suddenly disappeared.

“The initial market response speaks for itself, but for now, this is just a step in the right direction — investment, hiring and consumer spending are likely to slow as policy winds continue to swirl,” Mr. Skelly of Morgan Stanley said.

Others also cautioned that the rally could just as quickly reverse course.

“We’re not out of the woods yet,” said Mark Hackett, chief market strategist at Nationwide. “In periods of heightened volatility, sharp rallies are just as emotionally driven — and potentially misleading — as steep sell-offs.”

Alan Rappeport and Jack Ewing contributed reporting.