Image source: Getty Images

In my opinion, investing in the stock market is a great way to generate a second income. The majority of UK-listed companies and investment trusts regularly return cash to shareholders by way of dividends.

With this in mind, I recently took a position in Supermarket Income REIT (LSE:SUPR). I was particularly attracted by its yield of 7.5%. But as well as its potential to provide a decent income stream, it also has defensive qualities that could make it an ideal stock for the uncertain times in which we live.

What does it do?

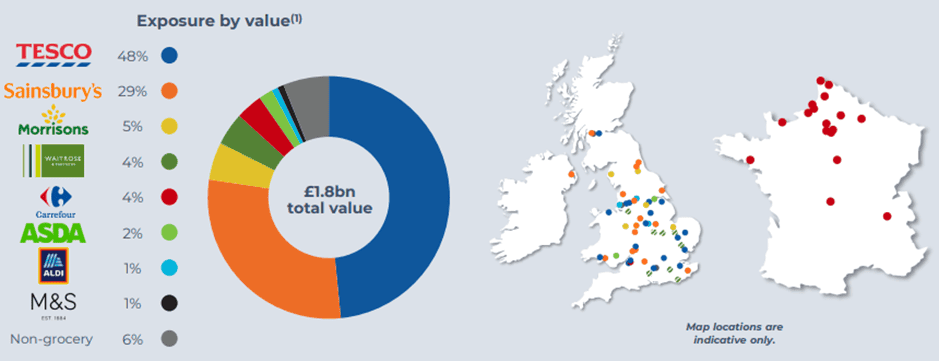

The investment trust buys large grocery stores and then leases them to retailers. It currently has 82 premises on its books and can boast Tesco, J Sainsbury and Carrefour among its tenants.

The quality of its customer base meant it had no bad debts during the year ended 30 June 2024 (FY24). Also, it reported a 100% occupancy rate.

To maintain certain tax advantages, a real estate investment trust must return at least 90% of its annual profit to shareholders. In FY24, it reported adjusted earnings per share of 6.1p and paid all of this as dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

How does it fund its growth?

With large amounts of cash being distributed, the trust’s acquisitions are usually funded by borrowings. This makes it vulnerable to interest rate rises on its variable-rate loans. However, it appears to have its debt under control.

Following a recent re-financing of some of its borrowings, it claims to have a loan-to-value (LTV) of 31%. This is based on a portfolio valuation of £1.8bn.

I’m wary of commercial property valuations as the market can be volatile and, given the size of these stores, there are relatively few retailers that are large enough to occupy them. But the £1.8bn estimate would have to be massively over-stated — which I think is unlikely — for the LTV to be a concern to me.

Encouragingly, the group’s borrowings are due to be repaid over a shorter period than the length of its customer contracts. All things being equal, this means the cash flows from each lease should improve over time. The weighted-average term of its unexpired leases is 12 years.

Slow and steady

The trust’s currently trading at a 9.3% discount to its net asset value. This implies its shares are a bit of a bargain. But a discount is common among REITs.

However, the gap has closed over the past six months or so, suggesting that more and more investors are attracted to the trust’s defensive qualities and its dividend. The average discount over the past 12 months has been 18.1%.

Of course, defensive stocks generally don’t experience rapid increases (or falls) in their share prices.

However, the commercial property market in the UK and France is unlikely to be affected by Trump’s tariffs or a global trade war. Supermarkets will always need premises, even if their earnings fall. This makes them ideal tenants. And they’re tied in via long-term contracts, some of which have provisions for inflation-linked rent increases.

These reasons — along with its above-average dividend — are why I recently added Supermarket Income REIT to my portfolio. Other income investors could consider doing the same.