Image source: Getty Images

Pleasingly for local income investors, the UK stock market has a strong culture when it comes to paying dividends. This means people holding products like a Stocks and Shares ISA have a wide range of shares to choose from when targeting a robust and reliable passive income.

The FTSE 100 and FTSE 250 are loaded with companies boasting market-leading positions, diverse revenue streams, and rich balance sheets. Many of these operate in mature industries with limited growth potential, too: this means they’re more likely to return surplus cash to shareholders than invest it for future growth.

This rich selection means investors can create income-generating portfolios that are closely tailored to their specific investment goals and appetite for risk. It also allows for terrific diversification that can generate a strong second income at all points of the economic cycle.

A mini-portfolio

Here’s what a well-diversified ISA portfolio could look like today:

| Dividend share | Sector | Years of continued dividend growth | Forward dividend yield |

|---|---|---|---|

| BAE Systems | Defence | 21 | 1.8% |

| Legal & General Group | Financial services | 4 | 8.4% |

| Coca-Cola HBC | Consumer staples | 12 | 2.5% |

| Sirius Real Estate | Real estate | 11 | 5% |

| Rio Tinto | Mining | 0 | 6.2% |

| Bloomsbury Publishing | Media | 25+ | 3.3% |

| Merchants Trust (LSE:MRCH) | Investment trusts | 25+ | 5.3% |

| Foresight Solar Fund | Renewable energy | 10 | 9.3% |

| HSBC | Banking | 4 | 5.3% |

| Primary Health Properties | Real estate investment trusts (REITs) | 25+ | 7.4% |

As you can see, this selection of Footsie and FTSE 250 shares covers a range of cyclical and non-cyclical industries. It also includes companies with long records of annual dividend growth. These businesses have helped investors protect their income from inflation by providing consistent, growing payouts year after year.

Finally, many of the dividend stocks here have long histories of paying dividends above the UK share average. For this year, the average dividend yield for this grouping is 5.5%.

Top trust

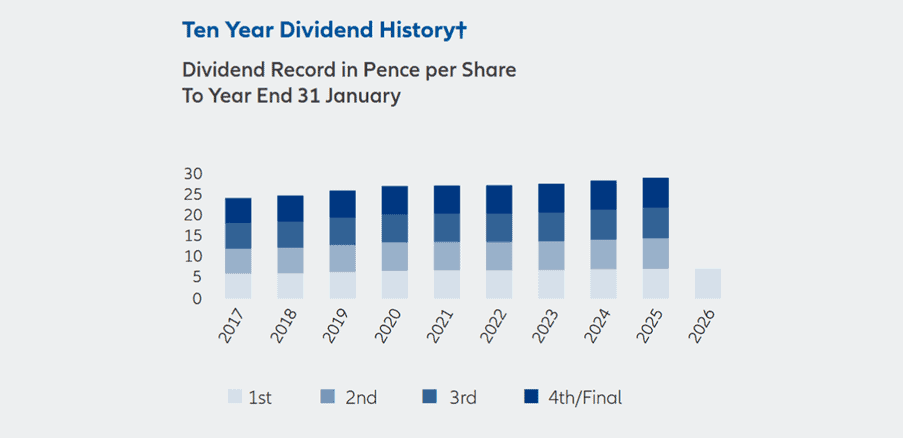

Let me explain why investment trusts like Merchants Trust can be powerful tools for targeting passive income. This particular one has grown annual payouts for 43 straight years, and provides a dividend yield far ahead of the FTSE 350 average of 3.3%.

These financial vehicles own a basket of assets, which provides investors’ portfolios with even better diversification. This Allianz-owned one holds shares in 52 different companies, ranging from banking stock Lloyds and pharmaceuticals developer GSK, through to utilities company National Grid.

Merchants Trust is also focused on the more robust companies found on the FTSE 100 and FTSE 250 as well. This provides it with added strength that supports strong and consistent dividend growth.

A focus on UK shares leaves the trust more exposed to regional difficulties than more geographically diversified ones. However, this could also pay off over time if the recent rotation into British stocks from US shares continues.

Targeting a large ISA income

Based on this year’s 5.5% forward dividend yield, our mini ISA portfolio of shares could deliver a £1,100 passive income this year on a £20,000 lump sum investment.

What’s more, if their dividends grow by an average 5% a year over the next 25 years, it could provide a second income of £3,725 at the end of the period.

Dividends are never guaranteed, even with a diversified portfolio. But I’m confident this set of shares could deliver a robust long-term passive income.