Summary

- Costs of electric vehicles in the US could drop by $6,000+ with LFP batteries.

- The Chinese EV industry dominates with over 80% of new EVs using LFP technology.

- GM, Samsung, and LG plan to convert US battery plants to produce LFP batteries for mass-market EV models.

Electric vehicle costs in the US could drop by $6,000 or more. Ford, GM, and Tesla have all invested heavily in LFP battery production in the US, partnering with LG, Samsung, and in the case of Ford, using tech from Chinese battery giant CATL. Stellantis has also partnered with CATL to build an LFP factory in Spain.

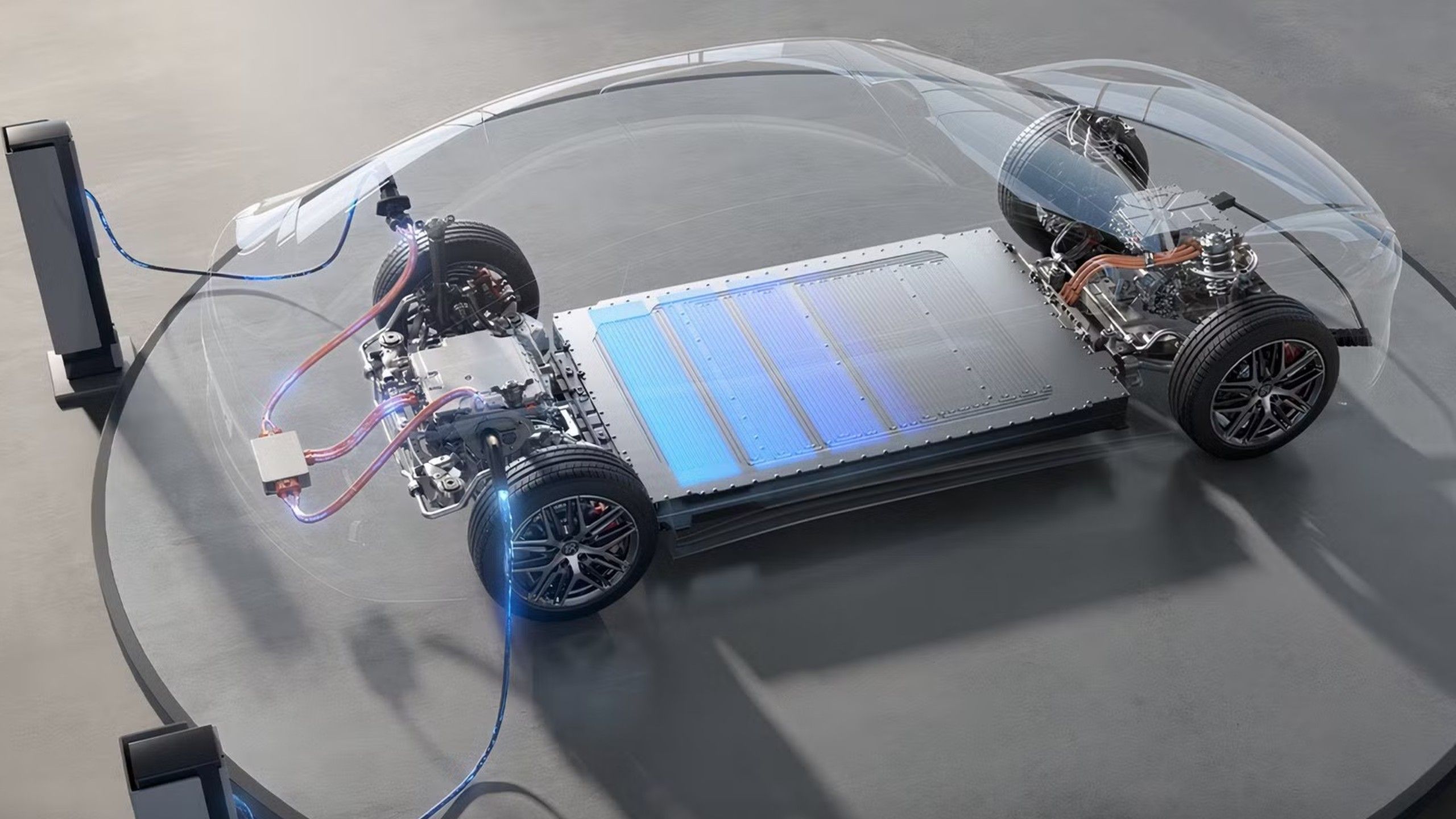

Lithium-iron Phosphate or LFP is cheaper than the original Lithium-ion NMC that the EV industry was built on, but until quite recently, this technology was not suitable for use in most EVs. Major technological advances, mainly in China, have improved LFP batteries to the point where they’re replacing Lithium-ion batteries around the world.

The dominance of the Chinese EV industry — with BYD recently surpassing Tesla as the biggest EV maker — is based on its LFP dominance to a large extent. Over 80% of new EVs in China use LFP, and this technology is gaining traction in Europe and other markets where China has a footprint. The only notable LFP in the US was in the Model 3 discontinued last year, as well as in mass storage batteries. However, it’s all about to change.

Related

5 China-made EVs blow the US competition away

These EVs from China are wiping the floor with global leaders. It’s a shame we won’t see them in the US.

GM, Samsung, and LG

Cost savings in mass-market models

Korean battery giants Samsung and LG plan to add LFP manufacturing capacity to their US plants co-owned by GM. These plants currently produce NCM (nickel-cobalt-manganese) batteries. This move is the result of pressure from GM to lower EV costs to boost lagging uptake.

GM’s strategy seems to envisage a two-tier system, with its mid-range, mass-market models using LFP, and its premium vehicles staying with NCM. Models like the Bolt, Equinox, Blazer EV, and Silverado EV will get LFP batteries, while the GMC Hummer EV and Cadillac Lyriq will keep using NCM. GM is known to be keen on LFP EVs under $30,000. Moving from NCM to LFP can cut battery costs by 20 to 30%, or at least $6,000 per vehicle.

GM’s move is in line with expectations in the industry, where cost pressure on EV are rising. The move to LFP for volume vehicles will likely happen across all carmakers with EVs in their lineups.

Related

Full-size electric pickups: the great, the good, and the weird

Big pickup trucks are great, but big EV pickup trucks are better.

Converting existing plants

Samsung and GM have a $3.5 billion joint venture facility in Indiana set to begin production of NCM batteries in 2027, and will convert part of this capacity to LFP. Samsung is currently securing supply chains and redesigning equipment for this move.

LG will convert its existing plants in Tennessee and Ohio to allow LFP manufacturing there.

Ford Michigan plant

Bringing manufacturing back

Ford has publicly acknowledged China’s technological lead in EVs and their batteries, and it faced massive criticism when it started building a battery factory in Michigan in 2023 that would depend on Chinese technology. Ford defended its decision to use CATL’s tech under license at the plant because it would bring back manufacturing expertise long ceded to China. This initiative will not only create jobs in the US, but also give Ford access to the technology it needs to compete globally.

Ford plans to launch the LFP batteries in a series of affordable EVs from 2027 on. It isn’t clear how much of a role CATL will play in the Ford venture, beyond the original licensing agreement.

Related

Why Ford’s CEO drove a Chinese EV for six months

Ford’s CEO loves driving a Chinese EV. Here is a look at why these EVs are not in the US, why they should be, and how this can happen.

Tesla’s Nevada battery factory

From big batteries to cheaper cars?

Tesla

Tesla, with its major presence in China, has long had relationships with CATL and BYD outside the US. A lesser-known, but quite massive, part of its business is producing enormous electricity supply systems (ESS), massive batteries that can charge during oversupply and feed the grid when power supplies are lower. Although its new Nevada plant is believed to use CATL LFP equipment and technology for these large storage cells, it could provide an indirect pathway into the US market.

This possible relationship is currently more in the realm of conjecture, but Tesla, like all EV makers, is under pressure to lower prices. This pressure will get more urgent once the EV tax rebate falls away at the end of September.

Related

At this point, it feels like Tesla might never make an affordable car

The production of Tesla’s new low-cost EV has reportedly been delayed.

LFP batteries

Invented in Texas, perfected in China

Mercedes-Benz

LFP (lithium-iron-phosphate) batteries were invented in Texas in 1997, and are cheaper than the ones using nickel and cobalt, because they use widely available materials. Until a couple of years ago, LFP was not really suitable for EVs, because they did not have the same energy density as lithium-ion batteries.They were used in mass storage, where size and weight were not an issue. But Chinese companies like CATL and BYD have invested heavily in this more affordable technology and managed to increase the density in specifically designed batteries, bringing range, size, and weight into parameters that make them ideal for EVs.

These companies now control most of the patents and manufacturing expertise needed to make LFP batteries.

Related

3 reasons Tesla’s sales are tanking

Tesla’s sales are dropping, and this slide started before Elon Musk got into politics. We look at what, when, why, and what next.

LFP vs NMC-based

Both LFP and NMC batteries have advantages and drawbacks.The advantages of LFP are:

- Raw materials are cheaper and easier to find

- Cheaper to manufacture

- Does not use cobalt, often sourced from conflict areas

- Can handle heat and high voltage better

- Degrade slower

- Less prone to overheating or catching fire

Disadvantages of LFP are:

- Lower energy density

- Shorter range for same size battery

- Slower charging in cold weather

Advantages of NMC:

- More energy density

- More power and range

- Can charge faster

Disadvantages of NMC

- Degrades in heat and with high voltage

- Relies on conflict materials

- More expensive

Related

China-made EV batteries charge quicker than fuelling up at a gas station

Electric vehicles will soon be able to recharge batteries in less than five minutes.

LFPs are still very new

LFPs have only really been an option for EVs from around 2020, and the technology is rapidly improving. BYD, for example, has developed its Blade Battery, which allows LFP to get the same power and range as NMC-type batteries. GM has just unveiled a manganese-rich battery which it considers a game-changer; others are working on graphene, while the elusive solid-state battery should go into production pretty soon.

If and when all this falls into place, EVs will soon be at least as affordable as ICE vehicles, with long ranges and fast charging. The move to launch LFPs in the US will allow the likes of Ford, GM, and Tesla to stay relevant in an electric world.