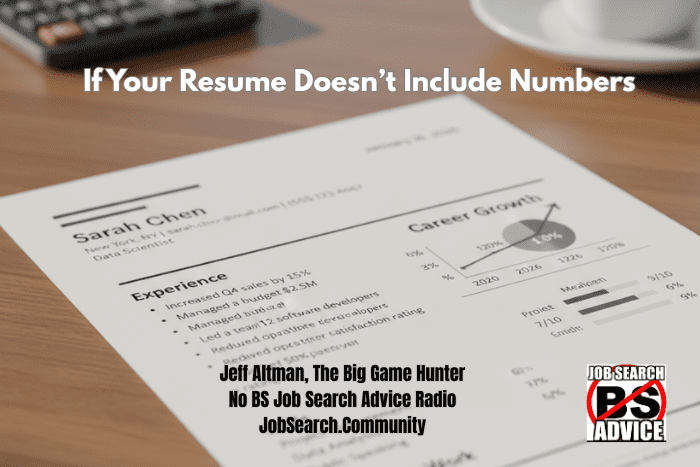

By Jeff Altman, The Big Game Hunter Click here if the video does not play properly This is a basic resume mistake people make. What Recruiters Know That You Don’t: They Aren’t Watching All Those Screening Videos If your resume doesn’t have numbers on it, it’s just a poem. It’s…

Bitcoin-to-Gold Bottom Fractal is Breaking as BTC Looks for a Bottom

For years, Bitcoin (BTC) traders have watched its price relative to gold (XAU) for clues on when BTC bottoms in US dollar terms. But in 2026, that BTC-to-gold signal is starting to look less dependable. Key takeaways: Bitcoin hits undervaluation versus gold and has slipped below its Power Law trend.…

Can this strongly-tipped UK stock really soar 55% in 2026?

Image source: Getty Images If we want to see a seriously bullish analyst take on a UK stock, we don’t need to look much further than Entain (LSE: ENT). It has one of the strongest consensus Buy ratings I can find for a FTSE 100 company, and broker price targets…

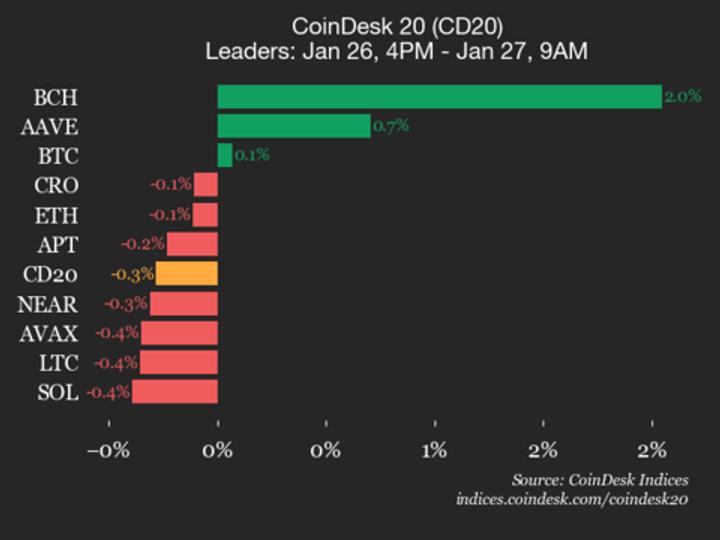

Bitcoin Cash (BCH) Gains 2% While Index Declines

Pudgy Penguins is emerging as one of the strongest NFT-native brands of this cycle, shifting from speculative “digital luxury goods” into a multi-vertical consumer IP platform. Its strategy is to acquire users through mainstream channels first; toys, retail partnerships and viral media, then onboard them into Web3 through games, NFTs…

‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run

Bitcoin (BTC) traders highlighted multiple signals, predicting a “massive” price upswing. Still, onchain data shows that BTC price recovery could be delayed as market participants take a more defensive stance. Key takeaways: Bitcoin surged 600% in 2021 after a similar key bullish cross was confirmed. Onchain data points to persistent…

$18.9bn! This British billionaire just smashed the S&P 500 with these stocks

Image source: Getty Images Many fund managers have struggled to beat the red-hot S&P 500 in recent years. However, Sir Chris Hohn handily outperformed the index in 2025, with a reported net return of more than 27% versus the S&P 500’s 18% total return. Incredibly, the British billionaire earned an…

Is It Illegal to Keep Someone Waiting for an Hour? #shorts

By Jeff Altman, The Big Game Hunter Click here if the video does not play properly My boss purposely makes all interview candidates wait 1 hour past the scheduled interview time. This is their “filtering” method, as they refuse to consider anyone who leaves during the 1+ hour wait. Is…

Australia’s corporate regulator flags risks from rapid innovation in digital assets

The Australian Securities and Investments Commission (ASIC), an independent government body acting as the national corporate regulator, has identified regulatory gaps in fast-growing fintech areas, especially digital assets. The regulator’s new report titled “Key issues outlook 2026” released Tuesday expressed concerns that consumers are exposed to the rapidly expanding and…

Does this growth share have a 42% valuation gap that the market hasn’t woken up to yet?

Momentum is building behind this well-established FTSE 250 growth share, as its performance strengthens across key areas. However, I believe the market has yet to fully reflect this outlook, leaving the valuation looking increasingly disconnected from reality. So, how compelling an opportunity is this to me now? Rising earnings growth…

Self-Promoting Yourself Into a Job

Self-Promoting Yourself Into a Job By Jeff Altman, The Big Game Hunter If you’re like most people, you’ve never written a press release to call attention to a success you’ve had. And rightly so. But some of you should be sending out press releases or encouraging your company to promote…