The Tesla (LSE: TSLA) share price suffered a roller-coaster ride over the past few months. It enjoyed a brief jump in January and then spent February and March falling before recovering slightly in April and May.

However, this kind of volatility isn’t surprising for the stock. It closely mirrors price activity in late 2021 and early 2022, after which it declined to a low of $108.

Let’s look into the reasons for the current price action and where it may be headed in 2025.

Why the drop?

Several issues may be responsible for the recent declines. Firstly, Tesla’s highly anticipated robotaxi launch hasn’t panned out quite as well as hoped. While CEO Elon Musk promised a launch by August, lawmakers in Texas have requested delays amid safety concerns. Now, only a small number of vehicles are expected in an initial geo-fenced rollout, putting a damper on the enthusiasm.

The carmaker also found itself caught up in the very public falling out between Musk and US President Donald Trump. Naturally, this spooked the market, wiping over 14% from Tesla’s valuation in a matter of days. Investors are probably worried that the company could lose out on future subsidies or favourable treatment as a result of the fallout.

Meanwhile, Musk’s other ventures are also fuelling unease. SpaceX’s recent Starship explosion, though separate from Tesla, has added to a narrative of overreach and distracted leadership.

Wider macro challenges

Further from home, geopolitical tensions are not helping matters. The Iran-Israel conflict and increasingly strained US-China relations have created uncertainty, particularly for a company with global ambitions like Tesla. China remains a crucial market — and home to Tesla’s fiercest competition in the likes of BYD, Nio, and Xpeng.

Adding to these risks is the uncertainty around the US Federal Reserve’s interest rate policy. Stubbornly inflated rates have hit growth stocks the hardest, and with a sky-high valuation, Tesla is more exposed than most.

Valuation looks stretched

Tesla’s price-to-earnings (P/E) ratio is close to 180 — a level that would usually suggest significant overvaluation. But still, it’s not the highest on the Nasdaq 100 as tech stocks tend to have high P/Es.

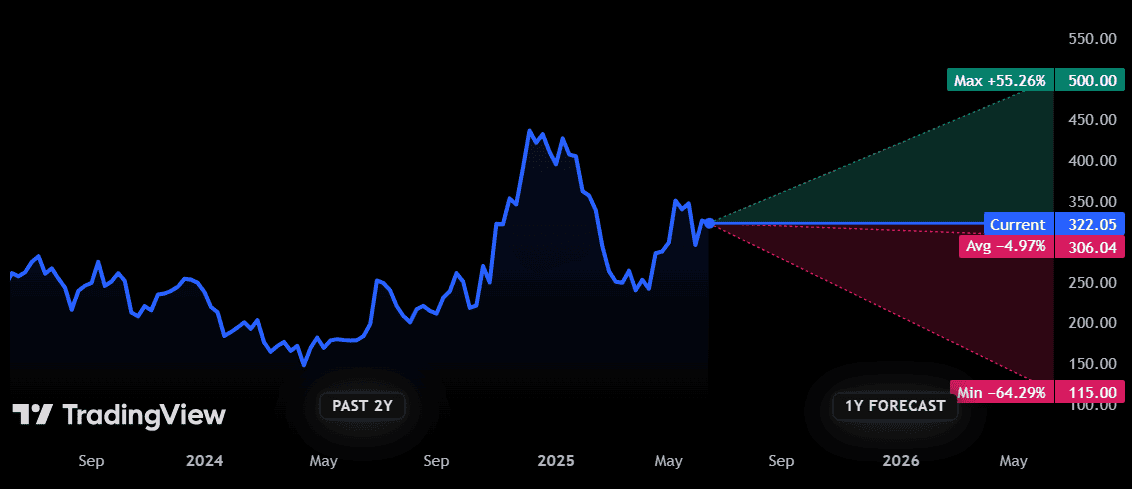

All these factors may be why analysts assessing the stock can’t seem to agree. The most pessimistic expect a 64% drop, while the most optimistic see a 55% gain. The average prediction implies a 4.97% decline over the next 12 months.

The not-so-Magnificent Seven

Despite the slump, Tesla remains the strongest performer in 2025 among the so-called ‘Magnificent Seven’ — the group of dominant US tech stocks that includes Apple, Amazon, Nvidia, Microsoft, Meta, and Alphabet. But sentiment may be shifting.

Investors are beginning to look beyond these mega-caps to new names in fast-growing sectors such as AI and cybersecurity. Companies like Palantir, CrowdStrike, Zscaler, and Fortinet could one day form the nucleus of a new generation of market leaders.

How much would a £10k investment be worth now?

The Tesla share price has recovered slightly since its April lows but slipped a further 2% this week. Overall, the stock is now down 15% since the beginning of 2025, making a £10,000 investment then worth only £8,500 now.

Looking at the broader market, I wouldn’t consider investing in Tesla right now. It may still be attractive to risk-averse investors but, for me, its future is too uncertain.