Image source: Getty images

The enormous tax benefits that Stocks and Shares ISAs provide can make them formidable weapons to target long-term wealth. Investors can put the money safeguarded from HMRC to work, boosting the compounding effect to help them grow their pension pot faster.

These tax savings have helped Stocks and Shares ISAs deliver an annual return close to 10% over the last decade. Yet despite these benefits, many Britons remain reluctant to use them due to their higher risk profile. The recent panic over rumoured cuts to Cash ISA allowances to encourage share investing is evidence of this.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

But investing on the stock market doesn’t have to involve taking on uncomfortable levels of risk. And with the poor returns on offer from Cash ISAs — the average annual return since 2015 is just over 1% — I myself believe using a Stocks and Shares ISA too is a no brainer (it’s why I currently use both types of account to target large returns and manage risk).

Getting personal

Investors can spread the risk they face by purchasing exchange-traded funds (ETFs) or investment trusts.

Pooled investments like these can allocate capital across a wide range of assets, with investors choosing the one that best balances their desired return and tolerance of risk. The Personal Assets Trust (LSE:PNL) is one such vehicle I think is an attractive way for ISA investors to consider building wealth.

More than a third (36%) of the trust is locked up in shares, its single most represented asset class. Major holdings here include UK and US blue-chip shares Unilever, Microsoft, Visa, and Diageo. That also adds risk linked to the performance of individual shares (like Diageo, which has been weak recently).

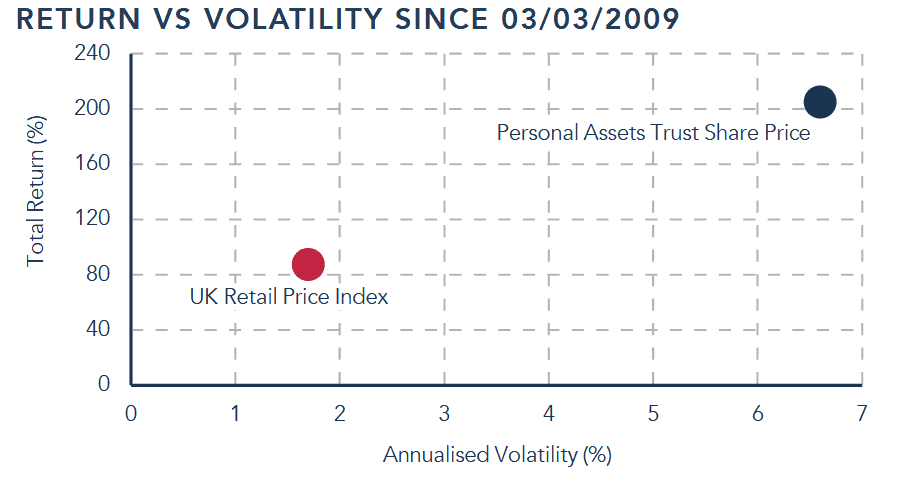

However, the rest is allocated to classic, stable assets like government bonds, precious metals and cash. As a result, investors still enjoy relative low levels of volatility, as the chart below shows:

Substantial safe-haven holdings today include gold bars (10.6% of the trust), US inflation-protected government bonds (26%) and short-dated Gilts (10%).

Since 2015, the fund has delivered an average annual return of 5.3%. That’s far better than a basic cash savings account has provided in that time.

Holy moly

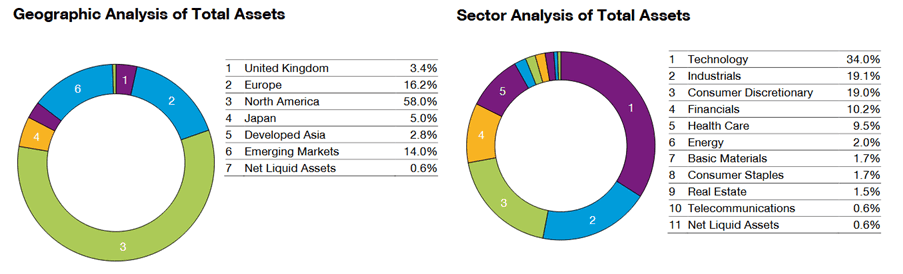

Investors chasing better returns can achieve this by considering trusts with greater allocations to equities. This involves more risk risk, though vehicles which invest across sectors and regions can still substantially reduce the danger to individuals’ cash.

Take the Monks Investment Trust (LSE:MNKS). The average annual return here is a brilliant 10.3%, achieved across scores of different companies (105 today) spanning the globe:

Major holdings here include the ‘Magnificent Seven’ Microsoft, Meta, Amazon and Nvidia. These companies can be volatile during economic slowdowns, but over the long term have provided strong returns as the digital economy has grown.

With management by financial services giant Baillie Gifford, investors

Both trusts expose investors to risks such as rising interest rates and market declines. Yet as their long-term performances show, they can still be a great way for cautious investors to generate long-term wealth and I think they’re worthy of further research.