Tesco (LSE:TSCO) shares spent a decade in the wilderness following the shocking 2014 accounting scandal. However, they’ve really started to motor higher in recent times, gaining 119% in five years and now sitting at a 14-year high.

The recent performance has been head-turning, with the FTSE 100 stock up 16.7% in just the past month. That’s enough to have turned a £7,500 investment made four weeks ago into about £8,755.

But there has been little company-specific news from the supermarket giant in the past few weeks. So what’s going on here?

Image source: Getty Images

Every little helps

From what I can see, there are a handful of macro and external factors that have been pushing the stock higher. First and foremost, the FTSE 100 has been on fire, jumping roughly 23% over 12 months and almost 7.8% year to date.

Often, a rising tide can lift all boats (assuming they haven’t go holes in them, which Tesco hasn’t).

Next, UK grocery inflation fell to 4% in the four weeks to 25 January, the lowest level since April 2025. This will come as a relief to inflation-weary shoppers, especially after the budget-straining Christmas period.

Easing inflation obviously gives consumers more confidence, potentially resulting in bigger baskets and more impulse buying of higher-margin products (the Finest range, clothes, toys, etc).

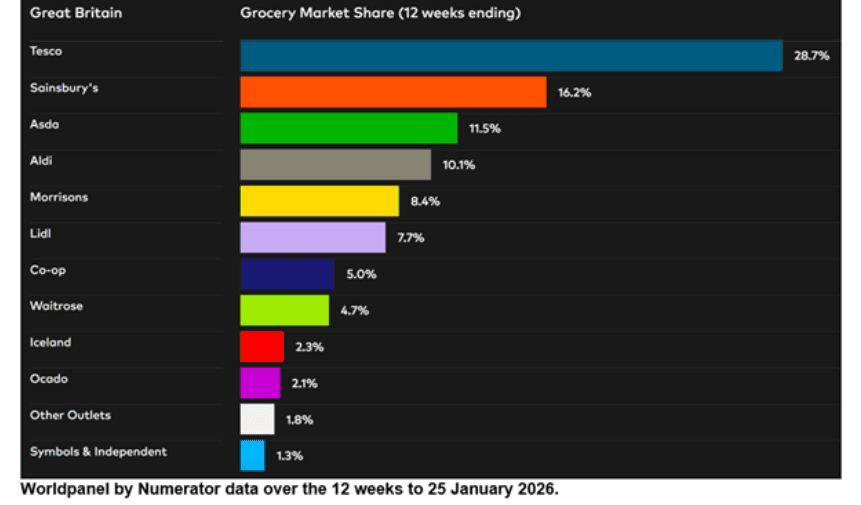

In the 12-week period to 25 January, sales at Tesco rose 4.4% year on year, according to Worldpanel by Numerator. And it extended its market-leading position, with its share edging up 20 basis points to 28.7%. That’s up from 26.5% in 2020.

It’s estimated Tesco gets more than £1 in every £10 spent in UK retail. Might we be creeping back towards the ‘Tescopoly’ days? Well, there’s still a way to go to get back to the 31.6% market share held at its peak in 2007. But Tesco is continuously chipping away at some rivals.

Meanwhile, share buybacks continue. Since launching its programme in October 2021, the supermarket giant has bought back nearly £4bn worth of shares. Buybacks can help support the share price, and Tesco’s has doubled since then.

An AI beneficiary

Finally, there’s been a sudden rotation out of software/data stocks potentially at risk from AI disruption. Investors have increasingly turned to stocks dubbed HALO, which stands for hard/heavy assets, low obsolescence (risk).

Tesco would certainly fit into this HALO category. It owns real things (hard assets) and is basically at zero risk of AI disruption.

Indeed, the business is harnessing the technology itself to become more efficient. For example, it has improved in-house tools to find the most efficient journey for every Tesco lorry and delivery van, shaving off approximately 100,000 miles per week.

Should I buy Tesco stock?

Tesco’s earnings multiple for 2026 is now above 17, which looks fairly valued to me. At this price, any earnings hiccups could get punished. And the 3.2% forecast yield isn’t tempting enough for me personally.

That said, given the factors I mentioned above (rising market share, easing inflation, buoyant FTSE 100, and the ongoing HALO trade), I think Tesco stock could keep doing well.

The 3.2% dividend yield is very well-supported, so I expect payouts to keep rising healthily. On this basis, the stock might still be worth considering for long-term income seekers.